Alternative Investments vs. Traditional Investments: Key Differences

admin - March 16, 2025Understanding Alternative Investments

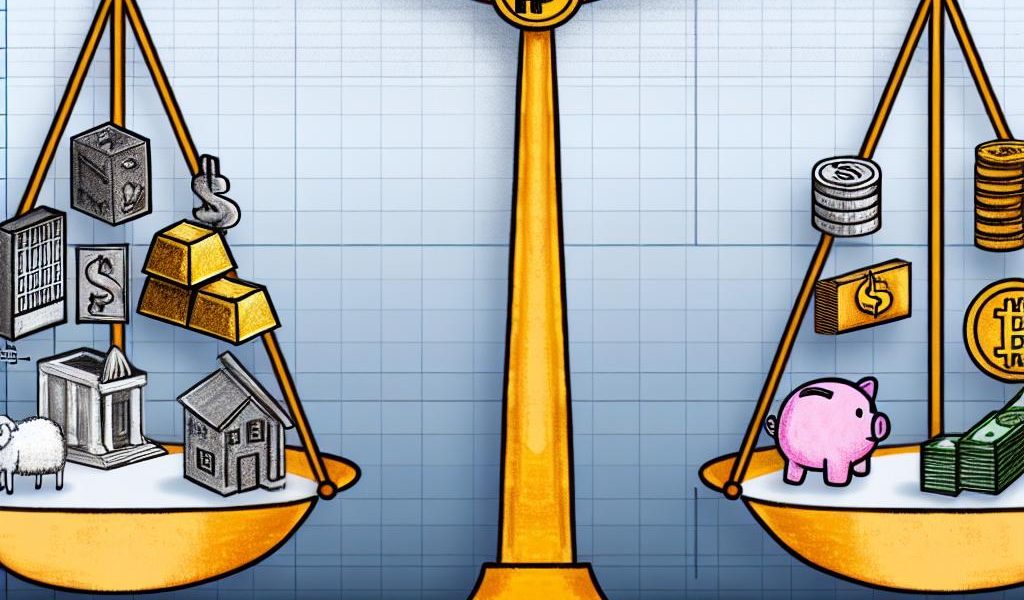

Alternative investments are financial assets that do not fit neatly into the traditional categories of stocks, bonds, or cash. They embody a broad spectrum of asset types, including real estate, commodities, private equity, hedge funds, art, and collectibles. With their unique characteristics, alternative investments often attract investors looking to diversify their portfolios and gain a hedge against market volatility. This is primarily because these investments typically do not directly correlate with the traditional financial markets, providing a distinctive risk-return profile.

Characteristics of Alternative Investments

Alternative investments are recognized for their complex structures, limited liquidity, and generally higher risk profiles when compared to their traditional counterparts. The nature of these assets often necessitates a longer investment horizon, primarily due to their lower liquidity. Engaging with these investments frequently requires a higher degree of specialized knowledge for effective management and due diligence.

Types of Alternative Investments

Traditional Investments

Traditional investments remain the cornerstone of many investors’ portfolios, consisting of well-known asset classes such as stocks, bonds, and cash equivalents. These asset classes are typically more accessible, regulated, and enjoy extensive market participation, thus providing a more familiar investment landscape for many.

Components of Traditional Investments

Key Differences Between Alternative and Traditional Investments

Liquidity

Traditional investments typically offer higher liquidity, facilitating easier buying and selling in established markets. Conversely, alternative investments may require longer periods to liquidate, particularly in niche markets like art or private equity, where finding a buyer can be challenging.

Regulation and Transparency

Alternative investments generally face less regulatory scrutiny compared to traditional investments, resulting in less transparency. This relative lack of oversight can contribute to increased risk and complexity, necessitating thorough due diligence from investors interested in these asset classes.

Correlation with Markets

One of the defining features of alternative investments is their lower correlation with the traditional market sectors. This characteristic can offer diversification benefits, potentially reducing overall portfolio risk during periods of market instability or downturns.

Risk and Return

Traditional investments often provide more predictable returns and are perceived as less risky. In contrast, alternative investments hold the promise of potentially higher returns, paired with increased risk. Investors must assess their own risk tolerance and investment goals when contemplating these types of assets.

Making the Choice

Deciding between alternative and traditional investments ultimately hinges on an individual’s financial objectives, risk appetite, and investment timeline. Both categories possess distinct advantages and can be strategically blended to construct a well-balanced portfolio. Comprehensive evaluation and advice from financial professionals can be invaluable in this process, guiding investors to align their strategies with personal and broader financial goals.

For those desiring more encompassing insights on effectively integrating alternative or traditional investments into their portfolios, consulting resources from reputable financial institutions or exploring specialized reports and industry analyses can be beneficial. These resources can provide nuanced perspectives and methodical approaches to investment strategies, aiding in informed decision-making.

This article was last updated on: March 16, 2025